tax service fee closing cost

A fee that may be tied to. Home buyers usually pay between about 2 to 5 of the purchase.

Fee Names On Loan Estimate And Closing Disclosure Must Match Alta Blog

Tax service fees are closing costs that are assessed and collected by a lender as a means of making sure that mortgage holders pay property taxes in a timely manner.

. This credit isnt free either. Processing Fee - here the lender is charging you for the cost of processing the loan. Typically the lender will either increase your loan amount to cover these.

The typical home value in Massachusetts is 583964. The escrow fee also known as the settlement fee or closing fee is based on the loan amount andor purchase price so expect to pay more on higher-cost homes. Some states charge an escrow fee or a closing fee.

Tax service fees exist since lenders need to. A tax service fee typically around 50 is collected and paid to an outside source. The role of a tax service agency is to look for.

Normally 1 of the loan amount. Regardless of where the title company. ESCROW SERVICE CHARGE This is the title companys fee for collecting and paying tax or any other item escrowed at closing.

This is paid to the title company escrow company or attorney for conducting the closing. The standard deduction for tax year 2021 is 12550 for single filers an d 25100 for married couples filing jointly. Closing costs can vary depending on where you live the mortgage lender youre working with and the propertys sales price.

A tax service fee is a legitimate closing cost that is assessed and collected by a lender to ensure that mortgagors pay their property taxes on time. It will increase in tax year 2022 to 12950 for single filers and. Document Preparation Fee - The cost of preparing loan documents for.

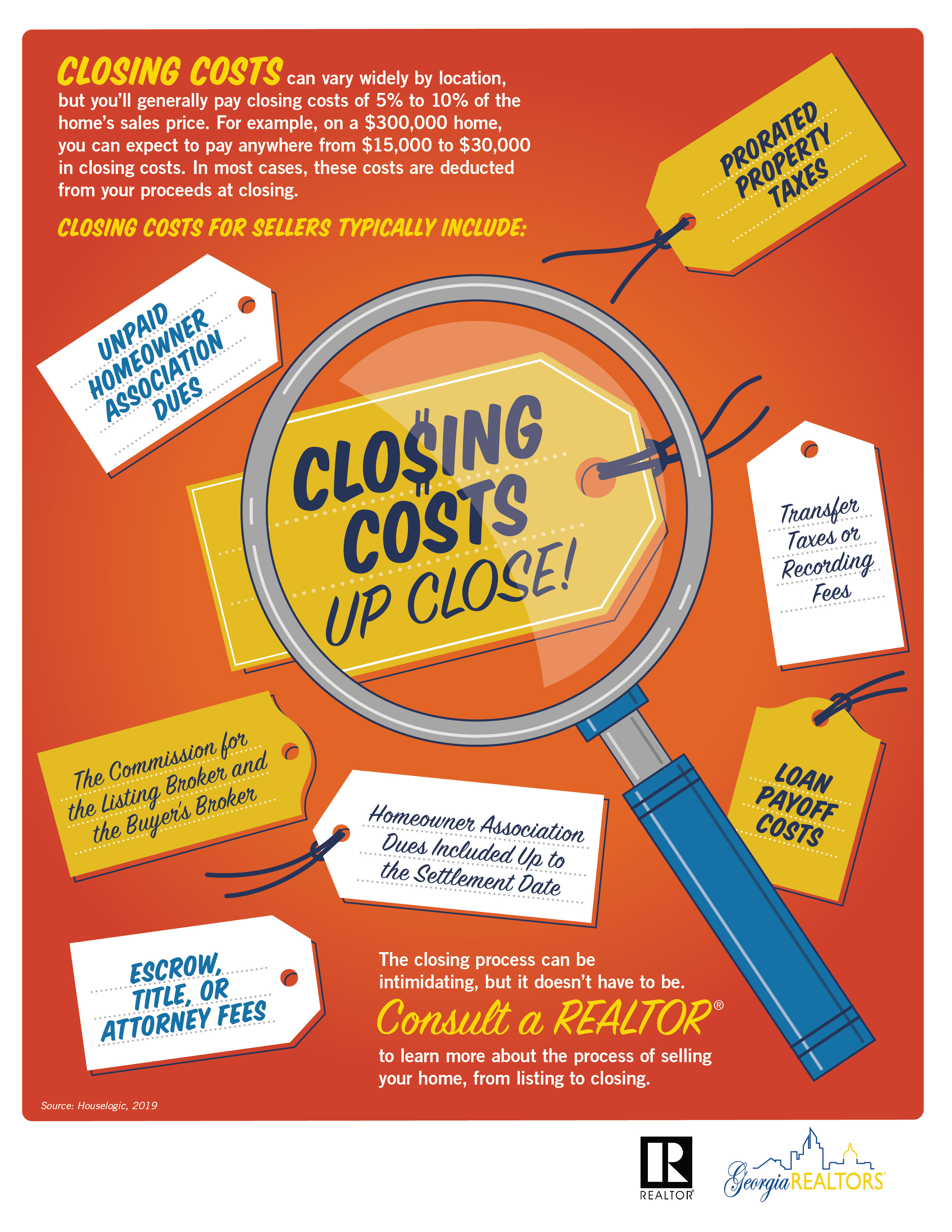

So if you are selling a house in Massachusetts you may have to pay 46717- 58396 as. Buyers and sellers also usually split the settlement or closing fee which can cost anywhere from 250 to 1500. Both the seller and the buyer pay closing costs.

A tax service fee is typically paid by the buyer at the time the home is purchased the lender then passes this sum on to a tax service agency. Appraisal fees attorneys fees and inspection fees are examples of common closing costs. Closing costs on a mortgage loan usually equal 3 6 of your total loan balance.

Lets put this in perspective. The cost equals the amount of the tax installment that is due. Its usually between 75 and 125.

A one-time fee payable to the Lender as an expense to obtain the loan. A fee typically 20-25 is paid to the credit service agency to obtain the report. The tables below show typical closing costs for buyers and sellers.

A tax service fee is a genuine closing cost that is assessed and collected by a lender to guarantee that mortgagors pay their property taxeson time. Sometimes you will see offers with negative points. Loan origination fee.

Each point is 1 of the loan amount. Seller closing costs usually add up to 8-10 of the sales price. On the other hand buyers disburse 2-6 of the purchase price.

The lender may also offer to give you a credit to help with your closing costs. Range 75 100. The closing costs that are tax deductible on your rental property may include your attorney fees state-required inspection fees other legal fees appraisal fees and.

For example if you have a loan amount of 100000 one point would cost you 1000.

Fee Names On Loan Estimate And Closing Disclosure Must Match Alta Blog

Donna Hennessey The Most Common Closing Costs Explained Mortgages Closingcosts Homebuyingnewhampshire Facebook

Who Pays Closing Costs Including Title Insurance Ohio Real Title

I Bought A Pre Construction House From Lennar Wci My Closing Is Due In 30 Days These Closing Costs Seems To Be Way Too High Any Input On This I M In Florida

How To Estimate Closing Costs Assurance Financial

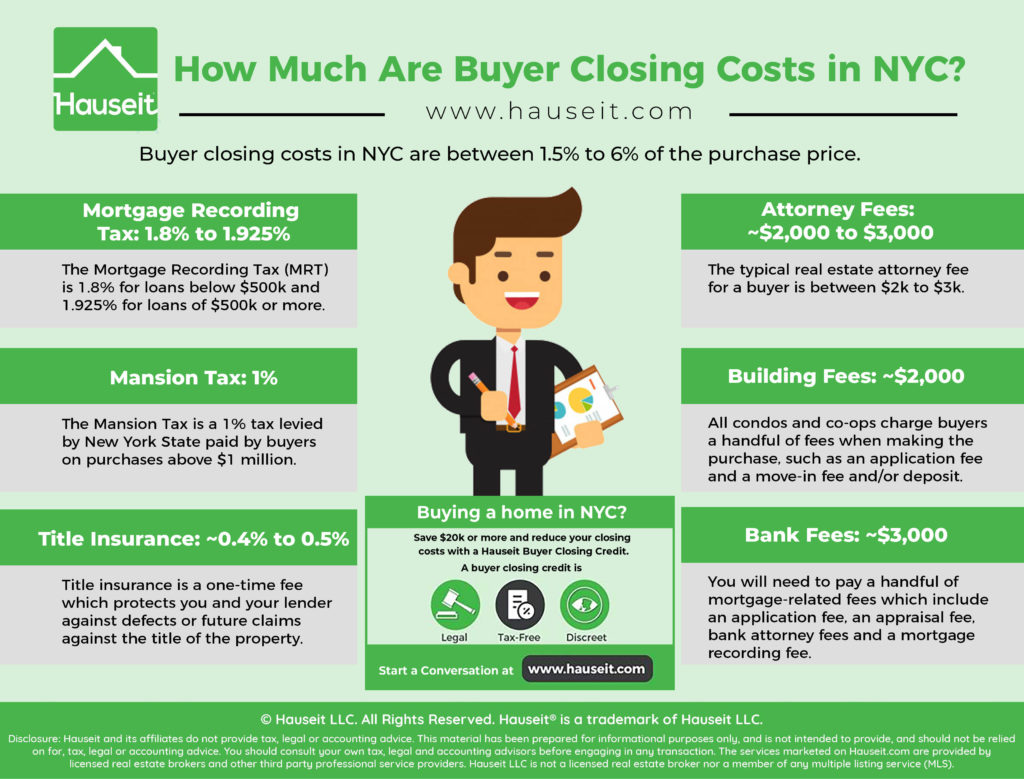

How Much Are Buyer Closing Costs In Nyc Hauseit

Closing Costs What Are They And How Much Rocket Mortgage

How To Claim Closing Cost Deduction On Income Tax Return

The Loan Estimate And Closing Disclosure What They Mean Nerdwallet

Closing Costs On A Conventional Loan Myfico Forums 1882547

How Much Are Closing Costs For The Seller Opendoor

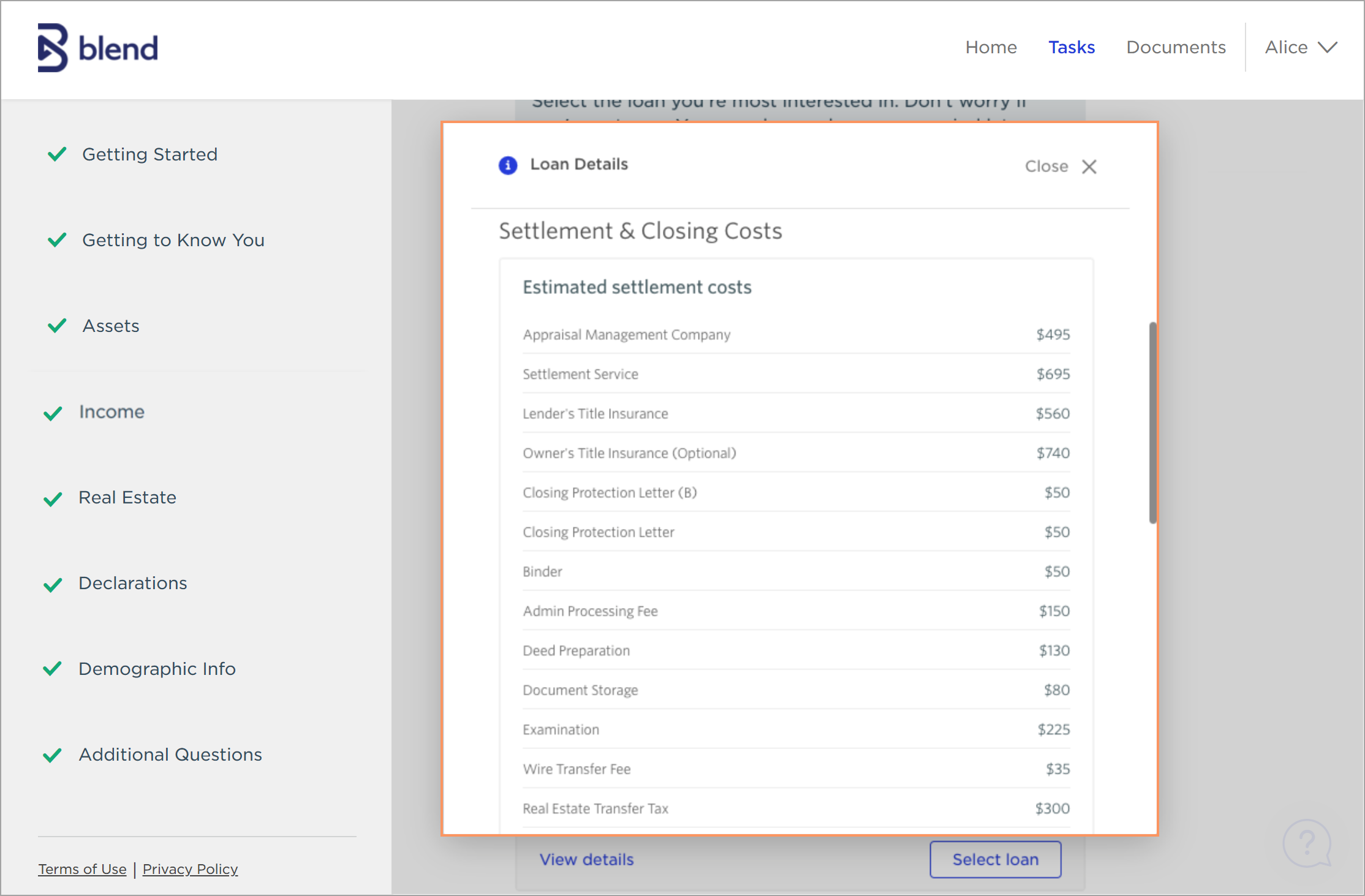

Lo Toolkit Fees Blend Help Center

2018 Closing Costs In Meridian Idaho Meridian Idaho Houses

How To Cover A Down Payment And Closing Costs In 2022 Benzinga

5 Types Of Tax Deductible Closing Costs Forbes Advisor

What Are Closing Costs Eagles Mortgage Company Inc Downey Ca

Closing Cost Who Pays What In Phoenix Arizona Phoenix Az Real Estate And Homes For Sale

.png)